eBaoCloud® DigitalCore Life

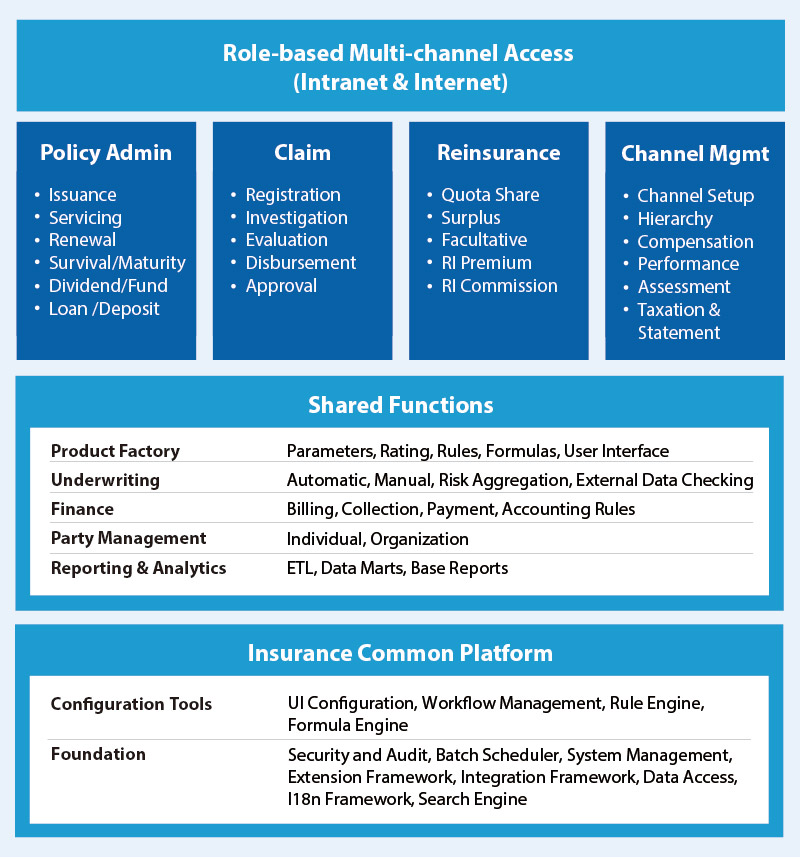

eBaoCloud® DigitalCore Life supports entire lifecycle operation of life insurance business, from new business, endorsement, claims, reinsurance, finance, compensation, and so others, with high degree of flexibility, configurability, and automation. It has been deployed in nearly 20 countries globally.

DigitalCore Life supports the following life insurance products:

- Traditional Life: term, endowment, whole life, mortgage life, waiver of premium, and fixed annuity

- Investment Life: investment-linked, universal life, variable universal life, and variable annuity

- Accident and Health: accident, critical illness / dread disease, hospitalization, long term care, and major medical

- New Types of Innovative Insurance Products: for micro and nano segmentations, scenario based insurance

Benefits at a Glance

-

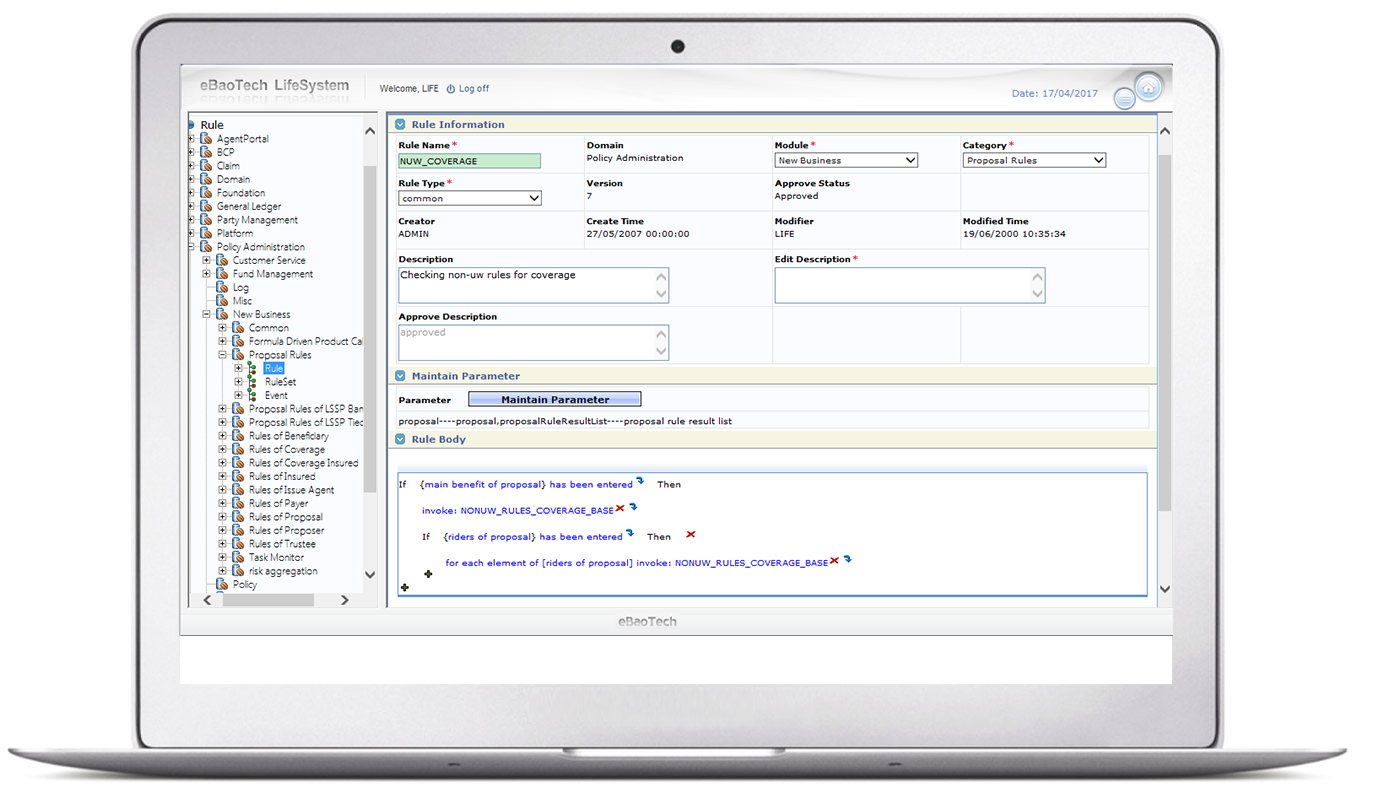

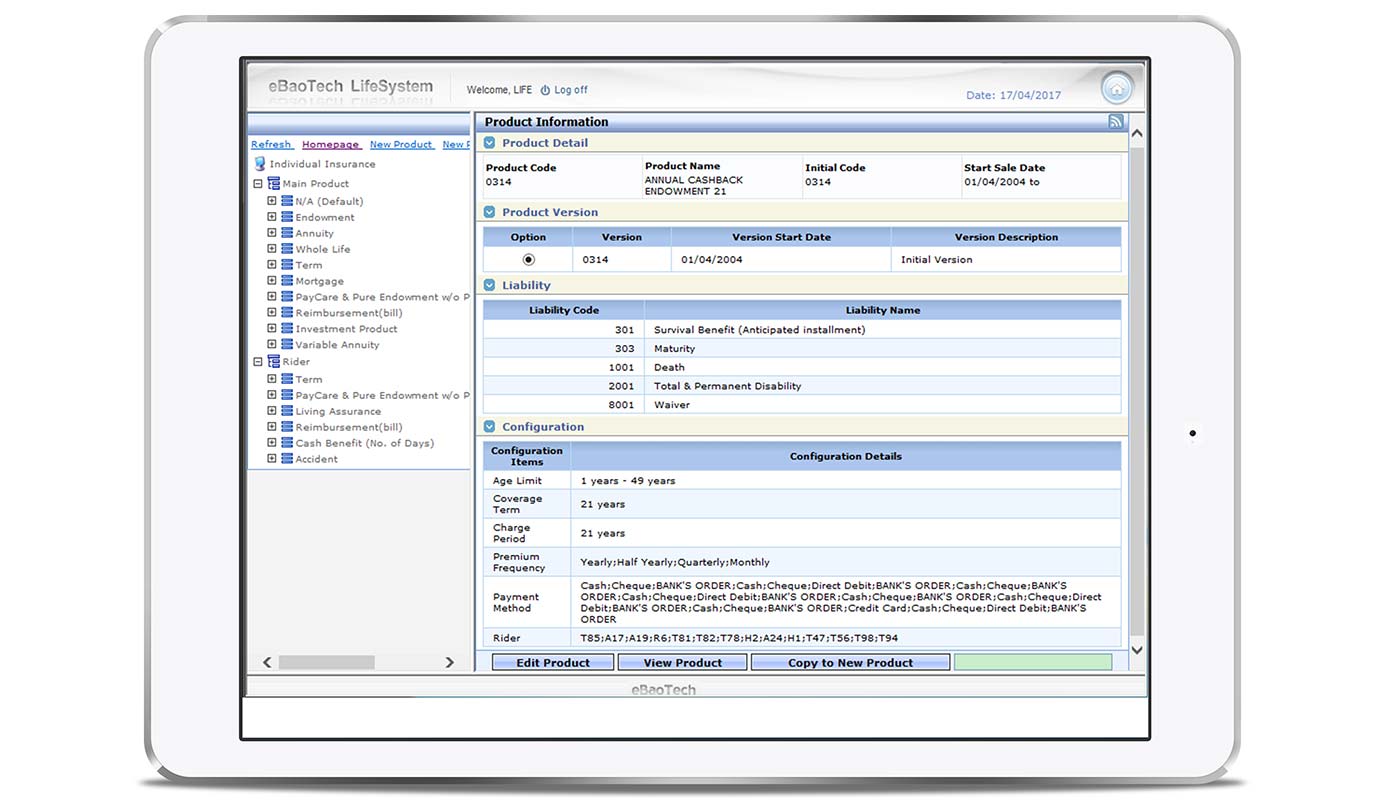

With Product Factory, insurers are able to offer personalized products and liability combinations, and launch products fast

-

Rating Engine and Rule Engine allow flexible customized products, such as personalized policy fees, sum insured and claim amount.

-

The Service Orchestration feature enables insurers to combine different flows according to business requirements.

-

The Open Integration Framework and Platform makes run-time plug-in possible and integration easy-to-manage.

-

The Big Data Analysis Platform helps insurers acquire customers’ information comprehensively so they can improve customer satisfaction and conduct precise up-sell and cross-sell.

See Other DigitalCore: DigitalCore General | DigitalCore Group Life